By Éric Toussaint

Governments and banking authorities systematically lie about the results of banks’ stress tests. Mainstream media relay the false information because it is dependent on the banks’ advertisement and moreover, certain bankers or their big shareholders are also shareholders in the media or in agencies such as Bloomberg which provides financial market analysis. The assistance schemes set up by central banks are not aimed at bringing urgent aid to the populations suffering from the coronavirus pandemic whether in Europe, the USA or Japan. The massive financial aids granted by the Central Banks are principally to save the big shareholders of the private banks and the capitalist system of domination in general.

It is fundamental to tell what is really happening in the banks and to convince more and more people about the necessity to expropriate, without indemnity, the big shareholders and to create a public system for savings, insurance and lending under citizens’ control. This is what CADTM calls the complete socialisation of banks and insurance companies.

This measure must be part of a larger programme of urgent, radical and far reaching measures that include suspending and eventually the abolition of public and private illegitimate debt, closing down the stock exchanges, creating an authentic National Health System, expropriating, without indemnities, the pharmaceutical companies and private laboratories, energy sector corporations (in order to plan and manage the ecological crisis) and placing them under citizens’ control aimed at improving the populations’ living conditions.

The response to the coronavirus epidemic should become an opportunity to encourage an authentic deep rooted revolution in life styles, property structures, mode of production, in the values that inspire social relationships among human beings as well as between human beings and nature.

This can only happen if the victims of the system mobilise themselves, self-organise and dislodge the 1% and their lackeys from positions of power to create truly democratic power structures. An ecological, socialist,feminist and self-management revolution is necessary.

Contrary to official announcements, the banks are in very bad health. Now, don’t get us wrong, the bad shape of banks do not prevent the huge incomes of their large shareholders, directors and top management. In fact, one of the reasons they are in such a bad shape is because they are being so thoroughly drained.

Over the last years the banks have been paying out very big dividends. Their directors are very well paid. But there is also an indirect way that shareholders make a lot money from banks! Banks are buying back their own equity.

The banks are repurchasing their own shares in order to make their large shareholders richer

One way used by major banks to increase shareholder income and wealth is to buy back their shares in the stock market. In recent years, they are doing this systematically and on a massive scale, particularly the US banks. If their share prices have, until the beginning of February 2020, rocketed, it is because the banks’ directors, in agreement with the principal shareholders are buying back their own stock, and often with the liquidities made generously available by central banks at derisory rates. And from whom do they buy back their own stock? From their own large shareholders; of course, who make huge money. Here’s how it works. Take for example a large shareholder who acquired a block of shares, of his own bank, at say 70 each. If the value rises to 100 and the big shareholder sells back to his own bank at 100 he make a gain of 30 per share. In some countries “capital gains” on shares are not even taxed under the pretext that stock exchange activity must be encouraged!

This is all very profitable for the big shareholders who are invariably stockholders and customers of several banks. In fact they are on the make both ways – capital gains on the portion of shares that are bought back and dividends on those that they keep.

When corporations announce a buy back, the shareholders are enthusiastic because they can expect a “bonus” in the form of a higher price per share from the closing price of the share. They are thus encouraged to hold onto their shares and accept the buyback offer. This in turn pushes the share price higher still. When a bank buys back its own shares at the same time it takes them out of circulation. This has another advantage. The price/earnings ratio (p/e) of the share is improved and this creates a higher demand for the shares that are still in circulation and the value of the bank shows further increase.

As the Financial Times, says : “Stock buybacks are neutral, in theory, for a company’s value as every dollar handed back to shareholders is a dollar less on its balance sheet. However, a reduction in the number of the shares outstanding increases earnings per share — which can often lift prices — while also boosting pay for managers”

It is to be noted that from early 2009 to end of September 2019, The big US banks dedicated $ 863 billion to buy up their own shares. After the sector dominated by Google, Apple, Amazon and Facebook had bought back its shares to a value of $ 1394 billion, it is the banking sector in the US that bought back the biggest volume of shares, much more than the industrial, energy and commodities sectors. The sum total of buybacks in the USA over the period mentioned is $ 5250 billion. It is one of the principal factors of the stock market bubble. The same phenomena is observable on other continents and is having the same effects.

Figure 1: The banks buy back their own shares

Figure 2: Sum total of buybacks by banks through 1st quarter 2007 to 3rd quarter 2019.

While stock markets are supposed to be the place where capitalist entrepreneurs raise additional capital as they sell shares to develop their companies, they actually function as temples for speculation where companies buy their own shares so as to favour their major shareholders. This is one of the reasons for which stock markets should be closed.

These are purely artificial movements of fictitious capital. But the illusion can last for years. And this is what just happened.

However, it could not last forever. For the last two or three years, several heterodox economists and many international bodies announced the imminent end of the bullish cycle on the stock market as it was obvious that a speculative bubble had developed and that it was about to burst. From mid-February 2020, as a consequence of the extending COVID19 pandemic and its impact on the Chinese economic driver, major shareholders considered that the feast was over and suddenly decided to sell large quantities of share packages. They were the first to sell and to pocket maximum profits. Several pension and investment funds followed and gave sell orders resulting in a sharp drop in share prices.

With the February-March 2020 crisis US banks announced by mid-March that they would stop buying their own shares, as pointed out by the Financial Times, insisting on this practice could be found outrageous.

In the course of March 2020, the discourse of leaders of major central banks, who wanted to be reassuring, produced the opposite effect. Bank shareholders considered that if central banks announced such significant measures (which I will further develop in another installment), it meant that things were turning sour and that there was no time to lose before selling what could still be sold before prices were even lower. Any rise in the value of bank shares over the last years was cancelled. But in the meantime major shareholders have booked their profits, as they say in the jargon of stock market commentators. They sold lots of share and pocketed the difference between the price they paid at the beginning of the stock market bubble and the beginning of the selling movement at the time of sales and liquidations. They sold to investment funds and to hedge funds looking for bargains. Majors shareholders have not sold everything: now that share prices are very low, they keep what they still have, so they still have a say in bank decisions (with 4 to 6% of shares, a shareholder can control a company, whether it is a bank or any other kind of company). They are waiting for the governments and central banks to launch some help programme and thus trigger a rise in share prices. It is much too soon to speculate on the duration of the crisis and the time it will take for stock markets to be bullish again. It can take a few months but also several years. Next to the duration of the pandemic and of the crisis in the manufacturing sector, social and political events can also impact on the time scale.

In the short term, banks will report losses and pay no tax. They will be swamped with new presents from the governments and central banks. We must be careful and distinguish between large shareholders, who still garner profits, and banks themselves, whose capital is melting away, whose share prices are plummeting and which will have to report losses and in some cases face bankruptcy. Large shareholders see banks as an optimal source of income even if it means pushing them to the brink of bankruptcy. They are convinced that the banks they hold shares of are too big to fail. They know that public authorities led by their friends in government and the central bank will help out the banks with taxpayers’ money. When share prices plummet they will promptly sell a large quantity of their shares, but will retain enough to control the company.

Large shareholders are protected by a law that says that the shareholders’ liability is limited to the shares they hold in the company. Even if they are responsible for huge losses, all they might lose is their initial stake. Now they did not put all their eggs in the same basket, they hold shares in several companies in various sectors and their assets are diversified. A large part of their wealth consists of more solid assets than shares: estates, art works, gold, yachts, private jets…

As I explained in previous articles (“The Capitalist Pandemic, Coronavirus and the Economic Crisis” and “No, the coronavirus is not responsible for the fall of stock prices”), we must be aware that large shareholders (and other speculators) are roller coasting in times when the stock markets are turbulent. When the market is bearish at the opening, shareholders sell share packages and during the day or on the following morning if the market is bullish again, they buy shares back when prices are very low. So there are days when stock market prices plummet followed by days when they rise again for a short while. But currently the trend is most clearly towards a collapse and shareholders are selling huge lots of shares.

Evolution of share prices of banks

In Europe

From 17 February to 12 March 2020, share prices of European banks literally plummeted, with losses between 30 and 45%. In the case of Natixis (which had been bailed out during the previous crisis), the fall amounted to 54%.

Over the same period, the shares of major Scandinavian banks also fell. Nordea (Finland) lost 38%, SEB (Sweden) lost 32%, Handelsbanken (Sweden) lost 28%, Swedbank (Sweden) lost 24%, Danske Bank (Denmark) lost 36%.

In the Americas

The shares of the eight largest US banks have fallen sharply; those of Canadian banks too but not as much. Shares pf major banks in Mexico, Columbia, Brazil, Chile and Argentina have also plummeted.

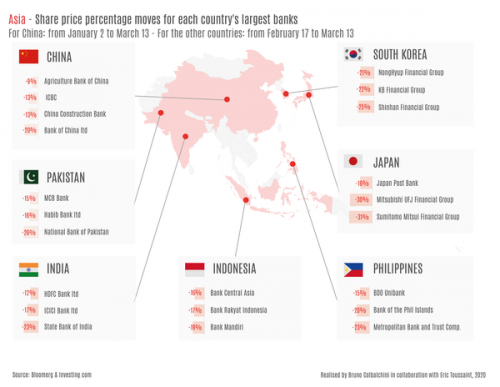

In Asia

All major banks in the major Asian countries also fell on the stock market. The fall of Chinese banks is more limited than in the rest of the world, but this fall had actually already started in January. Japanese banks have fallen most steeply.

In Africa

Bank shares of the four main African economies are also plummeting. Nigerian banks have been most hardly hit by falling share prices.

Ranking of banks according to the extent of the fall in their share prices from 17 February to 13 March 2020

We clearly see that shares of European banks fell most sharply from 17 February to 13 March 2020.

In a further installment I will develop an analysis of the current situation of banks. Next I’ll discuss other aspects of the international economic and financial crisis: the plummeting price of oil; the private bond market bubble’s first signs of bursting; private debt securities’ plunging prices and steep rise in yields and in risk premiums; rising prices of public debt securities. Governments of dominant economies are financed thanks to negative interest rates but they accumulate illegitimate debts. I shall also mention the dive of air companies and of aerospace industry. I will discuss the responses of central banks and governments.

Considering the fast development of the crisis, the structure of the series is susceptible to change. In each part I will propose measures to be implemented.

Translated by Mike Krolikowski and Christine Pagnoulle in collaboration with Sushovan Dhar for CADTOM

Courtesy International Viewpoint